CP 1 : High Probability Trade Strategies for Any Market and Any Time Frame

ANY MARKET, ANY TIME FRAME

The trade strategies you will learn in this book may be used for any actively traded market and any time frame. Stocks, exchange-traded funds (ETFs), futures, and Forex examples are used. The same market structure is made day in and day out in all of these markets and in all time frames, from monthly to intraday data. If an example is not a market or time frame you typically trade, ignore the symbol and focus on what is to be learned. The strategy taught will apply to all markets and time frames.

CONDITIONS WITH A HIGH PROBABILITY OUTCOME

The objective of any trade strategy is to identify conditions with a high probability outcome and acceptable capital exposure. You will learn the four main factors of any market position and how to identify if each is in a position for a high probability outcome. When a market is set up for change from four different perspectives, the trader has an enormous edge, much more so than if only one or two of the factors are in the same position. To win in the business of trading, just as in any other business, you must have an edge. The edge you learn in this book is to recognize when a market is in a position to complete a correction or a trend so you can enter a trade at the end of a correction in the direction of the trend or in the very early stages of the new trend and sell in the very late stages (often within one or two bars of the low or high). Just as a farmer must know the optimal time to plant and harvest a crop, the trader must know the optimal time to buy and sell a position. Buying or selling too early or too late can result in, at worst, unacceptable losses or, at best, not maximizing the return from a position. The trader must clearly understand the relevant information about the market position to recognize the optimal conditions to buy or sell. Markets can seem very complex. The plethora of relatively inexpensive trading software available with hundreds of studies and indicators can overwhelm a trader with often conflicting information, making it difficult to focus on the relevant information needed to make a confident trade decision. The high probability approach taught in this book recognizes four market perspectives: multiple time frame momentum, simple pattern recognition, price reversal targets, and time reversal targets. The information from any one of these four perspectives could be overwhelming. But in this book, you will learn how to focus on just those few bits of relevant information from each perspective that should quickly identify both the market position and whether a market is in a high probability position for a trade. I rarely do live workshops, but when I do I present a special exercise at the end of the session. I tell the students that I can apply what I have taught them to any symbol, including stocks, ETFs, futures, or Forex, and it will take three minutes or less to process all of the information needed to identify whether the symbol is in a high probability position for a trade setup or what that particular market must do to become a high probability trade setup. I have the students write any symbol on a piece of note paper. We collect them in a hat and I draw them out one by one. In less than three minutes, I apply everything I have taught them and arrive at a conclusion what is the probable market position of the symbol and the specific trade strategies. You, too, will be able to do this after you have studied this book and viewed the CD examples. If a trader focuses on just the limited, relevant information needed to make a high probability trade decision, the chance of success is great.

CP 2: Multiple Time Frame Momentum Strategy An Objective Filter to Identify High Probability Trade Setups

The Multiple Time Frame (MTF) Momentum Strategy is the most powerful approach I’ve discovered in over 20 years to filter any mar- ket and any time frame for trade direction and execution. The MTF Momentum Strategy is a key factor to the trade plan that identifies high probability trade setups with minimal capital exposure.

ust about every trading book or course will emphasize that you always want to “trade with the trend.” It’s great advice. If you are always trading with the trend, you should mount up some very impressive gains.

Two big questions are usually not clearly answered: “How do you objectively identify trend direction?” and “Is the trend in the early or late stages?”

In almost every trading book and course I’ve seen over the past 20 or more years, the trading educators show many after-the-fact examples of how their trend indicator identified the trend direction long after the trend was established. It is easy to show a trend on any chart long after the trend is established. But how do we identify trend direction in the early stages? How do we identify when an established trend is in the later stages and in a position to make a trend reversal? Without some approach to help identify where within the trend the market likely is, typical trend analysis will usually be too early or too late to be useful over time.

It is easy to fill a book with after-the-fact examples of trends. Trendlines, moving av- erages, channels, momentum indicators, and many other techniques can show the trend on historic data. Unfortunately, none of these techniques can reliably alert you to the beginning stages of a new trend or whether a trend is in its final stages. They can only identify an established trend, usually long after the trend is established and the optimum entry is long over.

I know, we could say that a trendline break indicates a trend is complete and a rever- sal has been made. For every trendline break that follows a trend reversal, I can show you a trendline break fake-out that is followed by a continuation of the prior trend. Moving average crossovers are notorious for false trend reversal signals.

In fact, most methods of identifying a price trend are doomed to failure for practical trade strategies with as many false reversal signals as confirmed ones. This is a bold statement, but I believe it is true. It’s time to stop the madness and and deal with the reality of trend position. I defy any trading educator to provide evidence that his so- called trend indicator consistently provides an accurate signal of trend position and trend reversal in a timely manner that a trader can take advantage of.

How can I make this statement? Let’s defy the crowd and think for ourselves in a logical manner. What does a trendline, channel lines, moving average, or other indicator represent? Every moving average, channel, or indicator is based on historic price data. It can only represent what has happened or what is the current market position relative to the lookback period. It has little predictive value in and of itself. It will always be a lagging indicator of the trend position, never a leading indicator of what is likely to happen in the future.

Why are some of these techniques promoted over and over again as “trend indica- tors” with value for making practical trade decisions? Because it is easy to find lots of chart examples that seem to illustrate how valuable are each of the author’s price trend indicators. However, let me make you this promise and this challenge. Name a trend in- dicator and for any market or any time frame that you are given an example of how it defines the trend, I will show you two examples where it quickly failed.

Every one of these techniques, whether a trendline, volatility channel, moving aver- age crossover, or momentum indicator, can be a useful part of a comprehensive trading plan, but none of them alone will be of much use in and of itself to identify the probable trend direction for a future period. Over and over again, you will find that price rever- sals do not coincide with the trend indicator reversals. As I mentioned earlier, for every after-the-fact, well-chosen example given, I will quickly find at least two where the trend indicator did not work to identify a trend reversal in a timely manner.

However, there is a way to use some of these indicators to identify high probability trade setups.

In this chapter, you will learn how to use just about any momentum indicator as a trend indicator for trade direction in a unique but very logical way that you have probably not been taught before. We are not concerned with identifying the exact price-swing high or low of a trend. Rather, we are concerned with identifying trades in the direction of the trend, including near the early stages of the trend and avoiding the later stages. The Multiple Time Frame Momentum Strategy that you are about to learn is the most powerful strategy to filter any market for trade direction and trade execution setups. Not only do I believe the Multiple Time Frame Momentum Strategy is the best use of an indicator for trading strategies, I believe it is the only practical indicator strategy for real-world trading.

The Multiple Time Frame Momentum Strategy is not a stand-alone trade system (al- though it is probably much better than most “systems” that sell for thousands of dollars), but when it is included as part of a trade plan with the time, price, and pattern strategies you will also learn in this book, you will have a powerful trade plan that will not only identify high probability trade setups with minimal capital exposure, but warn you when a trend is near the end and a major trend reversal is likely.

I use the term capital exposure to describe what many trade educators call risk. Risk is the probability of an event happening. Capital exposure is the amount of money (capital) that may be lost if a market moves against you. I have much more to say about capital exposure later in the book.

Let’s begin with the concepts of trend and momentum before we even look at a chart or the dual time frame momentum strategy rules.

WHAT IS MOMENTUM?

In the world of trading, there are hundreds of momentum indicators (also called oscil- lators). Most of these indicators use the same information, the open-high-low-close of a price bar, and represent about the same thing, the rate-of-change of price. There is nothing mysterious, magical, or unique about this. All price indicators look back over a given period, called the lookback period, crunch the price data, and compare the recent price position with the price position of the lookback period. Different indicators manip- ulate and display the output differently, but all price-based indicators represent about the same thing: the rate-of-change or how fast the price trend is moving. The indicator reversals represent the change in momentum—the increase or decrease in the rate-of- change of the price trend. That is why you can use almost any price based indicator for the Multiple Time Frame Momentum Strategy you will learn in this chapter.

The first and most basic concept is this: Momentum indicators do not represent price trends. Momentum indicators represent momentum trends. This should be obvious, but I can’t tell you how many new traders over the years expect a price reversal every time a momentum indicator reverses. It just doesn’t work this way, because the indicator does not represent the price trend. If it did, this book would be about three pages long because all we would have to do is reverse our trade position each time a momentum indicator makes a reversal, and we would compound money faster than rabbits on Viagra can reproduce.

Unfortunately, it is not that easy. Price and momentum do not always trend together. For example, a momentum indicator may make a bearish reversal and decline while the price trend continues to advance. How can it do this? The rate-of-change of the price trend is decreasing even though price continues to advance. The bullish trend is just slowing down, so the momentum indicator is bearish even though the price trend con- tinues to be bullish. The outcome: The price trend and momentum trend run opposite of each other.

Let me repeat this basic and very important concept about momentum indicators: Momentum indicators represent momentum trends, not price trends. Never expect price to reverse when the indicator makes a reversal. Often both price and momentum reverse together, but sometimes they will diverge because the price trend is only slowing down, forcing the indicator to reverse.

This point is important to clearly understand, and the vast majority of traders just don’t get it. So let me repeat it one more time: Momentum indicators represent momen- tum trends, not price trends. Price and momentum may not trend in the same direction. Not every momentum reversal will coincide with a price reversal.

We can only make money on price trends, at least until someone comes up with a momentum contract to trade! Even though momentum and price trends often do not move in the same direction, you will soon learn how we can use momentum trends in a simple and practical way as the primary indicator of trade direction and trade execution setups. You will also learn how, by incorporating dual time frame momentum trends in a comprehensive trading plan that also includes the time, price, and pattern position of a market, you can identify whether the market is at or very near a price trend reversal.

MULTIPLE TIME FRAME MOMENTUM STRATEGIES

In over 20 years of trading and educating traders beginning in the mid-1980s, Multiple Time Frame Momentum Strategies have become the most powerful trade direction and execution approach I’ve added to my trading plan and taught my students.

For at least the first 10 years I traded, I never used an indicator. I was basically a pure chartist using time, price and pattern position to identify trade setups and targets. My strategy was based on Gann, Elliott, and Fibonacci. In 1989, I released what I believe was the first futures trading home study course, called the W.D. Gann Home Study Trading Course, based on Gann, Elliott, and Fibonacci trade strategies. This course is no longer available.

It wasn’t until the late 1980s that I even had a computer with a charting program. I studied a lot about indicators and discovered I could always find an indicator or make a change in a lookback period or other setting for the indicator to confirm whatever price trend bias I had. There was never an indicator on my charts, simply because everything I read and tested on indicator strategies didn’t seem to work out, and I just could not find a logical and practical application for indicators.

Around the mid-1990s, at the prompting of one of my students, I began to look at how a momentum indicator could help confirm the pattern and price position. It took a couple of years to work out practical strategies for a momentum indicator to be a part of a real- world trading plan. Then, several years ago, I started working with momentum strategies using multiple time frames and was blown away with how valuable they could be as part of the trading plan, to identify trade direction and trade execution and to confirm a potential price reversal at price or time targets. Like everything I teach in this book, these strategies can be used for any time frame and any market, from day to position trading.

THE BASIC DUAL TIME FRAME MOMENTUM STRATEGY

I first teach the concept and application of a momentum strategy using two time frames. Later I give examples of how to use more than two time frames, but two are all you need. You will learn how to integrate this strategy into your trade plan.

It is that simple and logical. It doesn’t matter what time frames you use. If you are a position trader looking for trades that last from several weeks to months, you will use weekly and daily momentum trends. If you are a swing trader looking for trades that last a few days, you will use daily and hourly data. Day traders will probably use 60-minute and 15-minute data or even smaller time frames.

Let’s break down the Dual Time Frame Momentum Strategy into its parts to identify trade direction and trade execution setups.

Larger Time Frame Momentum Trend Identifies Trade Direction

We know the momentum trend will not always be in the direction of the price trend. But a good indicator with the right lookback period will usually trend in the direction of price and reverse within a very few bars of the price reversal. When price and momentum diverge, as in the case of a bullish price trend and bearish momentum trend, the larger time frame bearish momentum will keep us out of trades when the price trend is slowing down. The specific trade strategies you will learn in a later chapter will usually keep you out of a trade when the momentum trend is diverging with the price trend, which, at the least, will limit losses on losing trades. And remember, you will have losses, so a trade strategy that minimizes losses on losing trades is essential for trading success.

Dual Time Frame (DTF) Momentum Rule 1: Only trade in the direction of the larger time frame momentum trend unless the momentum position is overbought or oversold.

I’ll define the overbought and oversold exceptions soon.

The larger time frame momentum position identifies the trade direction. It does not signal that a trade should be executed; it only signals the direction of a possible trade, long or short. The smaller time frame momentum reversals are the specific signal that must be made before the trade is even considered. The smaller time frame momentum reversal does not execute the trade, but completes the conditions that must be in place before a trade execution may be considered.

Execute the Trade Following Smaller Time Frame Momentum Reversals

The key to momentum strategies is to use at least two time frames—a larger time frame to identify trade direction, and a smaller time frame for trade execution setups. We only want to take a trade if at least two time frames of momentum are moving in the same direction. That ups the odds big-time for the trade to be successful. This is such a simple and logical strategy that it should be a part of everyone’s trade plan.

If a trader only considers the momentum position of one time frame, he is at a great disadvantage. Momentum may trend consistently without making any reversals, but dur- ing that momentum trend, price will usually make corrections, sometimes sizable ones, without the momentum making a reversal. Or the speed of the price trend will ebb and flow without causing a momentum reversal. Wouldn’t it be best to be able to identify dur- ing the price trend when either a minor correction is likely to be complete or the speed of the trend might increase? That is what is accomplished by using the Dual Time Frame Momentum Strategy.

DTF Momentum Rule 2: A trade execution may be made following a smaller time frame momentum reversal in the direction of the larger time frame momentum trend.

The initial conditions for trade entry are met when the smaller time frame momen- tum makes a reversal in the direction of the larger time frame momentum trend. That gives us the best shot for the price trend making the biggest moves with minimal capital exposure.

Read More: Best Forex Trading Platforms

MOMENTUM REVERSALS

A momentum reversal is when the momentum indicator reverses from bullish to bearish or from bearish to bullish. A momentum indicator that has two lines, like a stochastic or a relative strength index, makes a momentum reversal when the fast line crosses above or below the slow line. The fast line in most two-line indicators is usually the raw data; the slow line is usually a moving average of the fast line. When the fast line crosses the slow line the momentum trend is likely reversing. A momentum crossover is similar to a moving average crossover except the momentum crossover is of the indicator values and not the price data itself. A momentum reversal for some indicators may be signaled by the momentum lines crossing above or below the oversold (OS) or overbought (OB) zones, if the indicator is the type with OS and OB zones.

Other indicators will have other conditions that reflect a reversal in momentum. With a moving average convergence divergence (MACD) indicator, when the bars be- come taller or shorter or cross the signal line, the momentum speed is changing. Each indicator will have different conditions that signal a momentum reversal but they all rep- resent about the same thing: The price trend is either reversing, slowing, or speeding up. Later we’ll see chart examples that show momentum reversals, but for now, you must

thoroughly understand the concepts before looking at a single chart with indicators. Un- derstanding the concepts first is the key to developing a specific trade strategy for any market and any time frame, under any market condition.

A smaller time frame momentum reversal into the direction of the larger time frame momentum is the Dual Time Frame Momentum setup for a trade. It is a precondition that must be met before a trade is even considered. A Dual Time Frame Momentum Strategy will be the best filter you have to identify optimum trades. It can be a stand-alone trade strategy, but we use it as part of a trading plan that also considers the price, pattern, and time position for high probability trade setups with acceptable capital exposure.

Trade in the direction of the larger time frame momentum. Execute following a smaller time frame momentum reversal. These are the setup conditions that must be met before a trade is considered.

Okay, it’s time to look at some charts and illustrate what you’ve learned so far, so at any time you can bring up a chart of any market and any time frame and almost instantly identify if the market is in a high probability position to consider a trade.

MOST PRICE INDICATORS REPRESENT RATE-OF-CHANGE

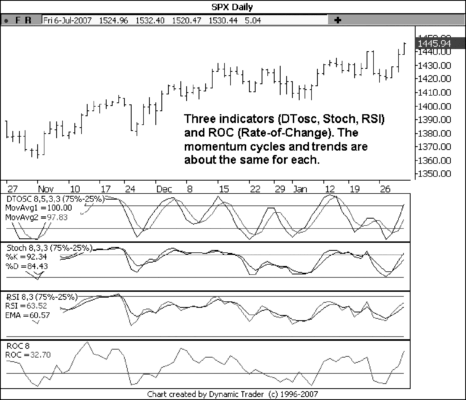

Figure 2.1 shows three different indicators with the bar chart plus a simple rate-of-change (ROC). The three indicators are a stochastic (Stoch), relative strength index (RSI), and DT Oscillator (DTosc), which is a combination of RSI and Stoch. All four studies have an eight-period lookback.

The momentum trends are about the same in all three indicators. While it is a little difficult to see this in the black-and-white screen shots, the momentum reversals for each indicator where the fast line crosses the slow line are all within a bar or two of each other.

What’s the point of this comparison? Most price-based indicators represent about the same thing, that momentum cycles act and react about the same time. The settings for any indicator, including the lookback period can be tweaked for different markets and different time frames for the most reliable signals. But, as you can see from Figure 2.1, even without tweaking the settings for each indicator they each still represented the momentum cycles about equally well. Later in this chapter you will learn how to choose the best settings for any indicator for any market and time frame.

Figure 2.2 is another screen shot with just two indicators, Stoch and DTosc, with less data so you can see the momentum cycles more clearly. I’ve drawn thick vertical lines in the indicator window at each bullish and bearish momentum reversal where the fast line crosses the slow line.

The momentum reversals in both indicators were made plus or minus one bar of each other. Either the Stoch or DTosc would be equally helpful to identify momentum reversals for this data. Don’t let anyone sell you on some magical, mystical indicator for momentum trading! All momentum indicators represent the same momentum cycles, and most make reversals about the same time. The black-box system scammers will claim they have a secret, foolproof indicator, but more than likely it is one you already have in your charting program.

There are only so many ways to crunch the open-high-low-close of price bars. Most variations come up with about the same result and can be equally useful. PUBG Name Generator