Work #Forex pairs are the foundation of trading in the foreign exchange market. Understanding how these pairs function is crucial for anyone looking to navigate the complex world of forex trading. In this comprehensive guide, we will explore into the importance of forex pairs, how they are calculated, and the risks and rewards associated with trading them. By the end of this article, you will have a solid grasp of how forex pairs work and be better equipped to make informed trading decisions in this fast-paced market.

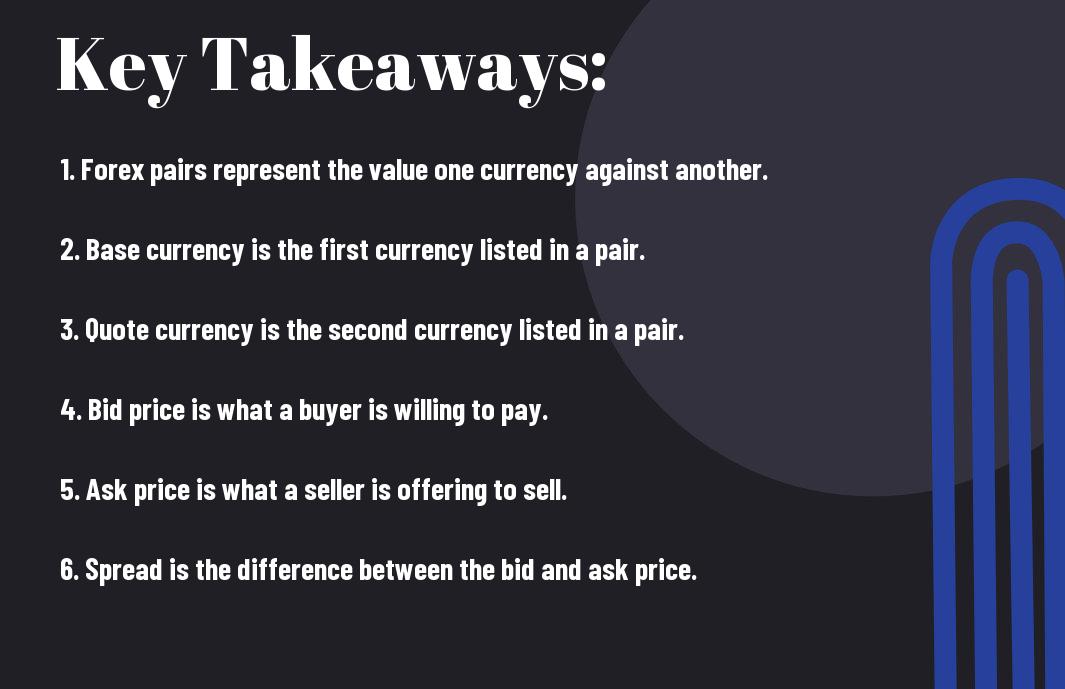

Key Takeaways:

- Forex pairs consist of a base currency and a quote currency, representing the exchange rate between the two currencies.

- Majors, minors, and exotics are the three categories of forex pairs based on liquidity, popularity, and trading volume.

- Currency pairs are quoted in either direct or indirect form, where the direct form shows how much of the quote currency is needed to buy one unit of the base currency, and the indirect form shows how much of the base currency is needed to buy one unit of the quote currency.

The Mechanics of Forex Pairs

Base and Quote Currencies

Any successful forex trader must have a firm grasp of how forex pairs work. One of the fundamental concepts to understand is the distinction between base and quote currencies. In a currency pair, the first currency listed is the base currency, and the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

How Currency Pairs Are Quoted

One of the key aspects of trading forex pairs is knowing how they are quoted. Forex pairs are typically quoted in two prices: the bid price and the ask price. The bid price is the maximum price that a buyer is willing to pay for a currency, while the ask price is the minimum price that a seller is willing to accept. The spread is the difference between the bid and ask prices, and it represents the cost of the trade.

A deeper understanding of how currency pairs are quoted can help traders make informed decisions. It is crucial to pay attention to the spread, as a wider spread can eat into potential profits. Additionally, knowing how to read and interpret currency pair quotes accurately can contribute to more successful trading strategies.

Types of Forex Pairs

For Forex traders, understanding the different types of forex pairs is important. The forex market consists of various pairs that are categorized based on their trading volume, liquidity, and popularity. There are three main types of forex pairs: Major Pairs, Minor Pairs, and Exotic Pairs.

| Major Pairs | Minor and Exotic Pairs |

| EUR/USD | EUR/JPY |

| USD/JPY | GBP/AUD |

| GBP/USD | USD/SGD |

| USD/CHF | NZD/CAD |

| AUD/USD | USD/TRY |

Major Pairs

For Forex traders, major pairs consist of the most heavily traded currencies globally and include pairs such as EUR/USD, USD/JPY, and GBP/USD. These pairs are known for their high liquidity and tight spreads, making them ideal for beginners and experienced traders alike. Major pairs are typically less volatile and offer lower risk compared to other forex pairs.

Minor and Exotic Pairs

Exotic Forex traders often venture into minor and exotic pairs, which include currency pairs that are less commonly traded such as EUR/JPY, GBP/AUD, and USD/SGD. These pairs are characterized by higher volatility and wider spreads, offering opportunities for greater profit but also increased risk. It is important for traders to exercise caution when trading exotic pairs due to their unpredictable nature and potential for significant price fluctuations.

The minor and exotic pairs can provide diversification in a trader’s portfolio, but it is crucial to carefully manage risk and be aware of the unique factors that can impact these forex pairs.

Factors Affecting Forex Pairs

Now, let’s investigate into the factors that impact forex pairs. Understanding these elements is crucial for trading effectively in the foreign exchange market.

- Economic Indicators and Events: To make informed decisions in forex trading, it is important to keep track of key economic indicators and events. Factors such as interest rates, inflation rates, GDP growth, and employment data can significantly influence the value of a currency pair.

Political Stability and Economic Performance

To succeed in the forex market, one must also consider the political stability and economic performance of a country. These factors play a pivotal role in determining the strength of a nation’s currency. Stable political conditions and positive economic performance can attract foreign investment and boost a country’s currency value.

One critical aspect of Political Stability and Economic Performance is the effect of geopolitical events on currency pairs. Any political instability or economic turmoil in a country can lead to a decrease in the value of its currency. Conversely, positive developments can result in a currency appreciation. Keeping abreast of such events is important for successful forex trading.

After considering these factors, traders can make informed decisions and navigate the complex world of forex trading with more confidence.

Strategies for Trading Forex Pairs

Fundamental Analysis

With fundamental analysis, traders focus on the economic factors that influence the value of a currency. This involves monitoring economic indicators, such as Gross Domestic Product (GDP), interest rates, inflation rates, and political stability of a country. Understanding these factors can help traders predict the future movement of a currency pair and make informed trading decisions.

Technical Analysis

One of the most popular strategies for trading forex pairs is technical analysis. This involves studying historical price charts and using various technical indicators to identify patterns and trends in the market. By examining price movements and volume data, traders can make decisions based on the past performance of a currency pair. It is important to note that technical analysis is not foolproof and should be used in conjunction with other tools and strategies for successful trading.

It is crucial for traders to continuously educate themselves and stay up-to-date with market news and developments to refine their strategies and improve their trading skills. By combining fundamental and technical analysis, traders can have a well-rounded approach to trading forex pairs and increase their chances of success in the market.

Final Words

Presently, understanding how forex pairs work is crucial for anyone looking to trade currencies in the global market. Knowing how currency pairs are quoted, the base and quote currency, and how exchange rates fluctuate can help traders navigate the complex world of forex trading more effectively. By comprehending the dynamics of forex pairs and how they interact with each other, traders can make more informed decisions and maximize their profits. It’s imperative to remember that forex trading involves risks, and it’s important to always do thorough research and analysis before making any trades. With the right knowledge and strategy, trading forex pairs can be a rewarding endeavor for those willing to put in the effort and stay disciplined in their approach.

FAQ

Q: How do forex pairs work?

A: Forex pairs work by representing the exchange rate between two different currencies. Each pair consists of a base currency and a quote currency, where the exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Q: What are the most commonly traded forex pairs?

A: The most commonly traded forex pairs are known as the major pairs. These pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They are often the most liquid and widely traded pairs in the forex market.

Q: How are forex pairs quoted?

A: Forex pairs are quoted in two prices: the bid price and the ask price. The bid price is the price at which the market maker is willing to buy the base currency, while the ask price is the price at which the market maker is willing to sell the base currency. The difference between the bid and ask price is known as the spread.