This comprehensive guide will teach you how to trade forex like a pro. Forex trading involves buying and selling currency pairs in the foreign exchange market, and it can be a lucrative endeavor if done correctly. Understanding the risks and intricacies of the market is key to successful trading. We will cover how to choose a broker, analyze currency pairs, use technical analysis tools, and manage your risks effectively. By the end of this guide, you’ll have the knowledge and confidence to start trading forex with skill and precision.

Key Takeaways:

- Understand the market: Study the factors that influence currency exchange rates and keep up with global economic news and events.

- Develop a trading strategy: Create a plan outlining your approach to trading, including entry and exit points, risk management, and trading tools to use.

- Practice risk management: Use stop-loss orders, set realistic goals, and only trade with money you can afford to lose to protect your capital.

Understanding the Fundamentals

Key Concepts in Forex Trading

The forex market operates on the basis of buying one currency while selling another simultaneously. This is known as trading currency pairs. Understanding the concept of leverage is crucial in forex trading as it allows traders to control a larger position with a smaller amount of capital. Another fundamental concept is volatility, which refers to the degree of price fluctuations in the market.

Major Currency Pairs to Know

Knowing the major currency pairs is imperative for any forex trader. The Euro (EUR), US Dollar (USD), Japanese Yen (JPY), and British Pound (GBP) are some of the most traded currencies in the market. These pairs offer high liquidity and relatively lower spreads, making them popular among traders.

Pairs: When trading major currency pairs, it is important to consider the economic indicators and geopolitical factors that can impact the value of these currencies. Understanding the relationships between these major pairs can help traders make informed decisions and predict future price movements more accurately.

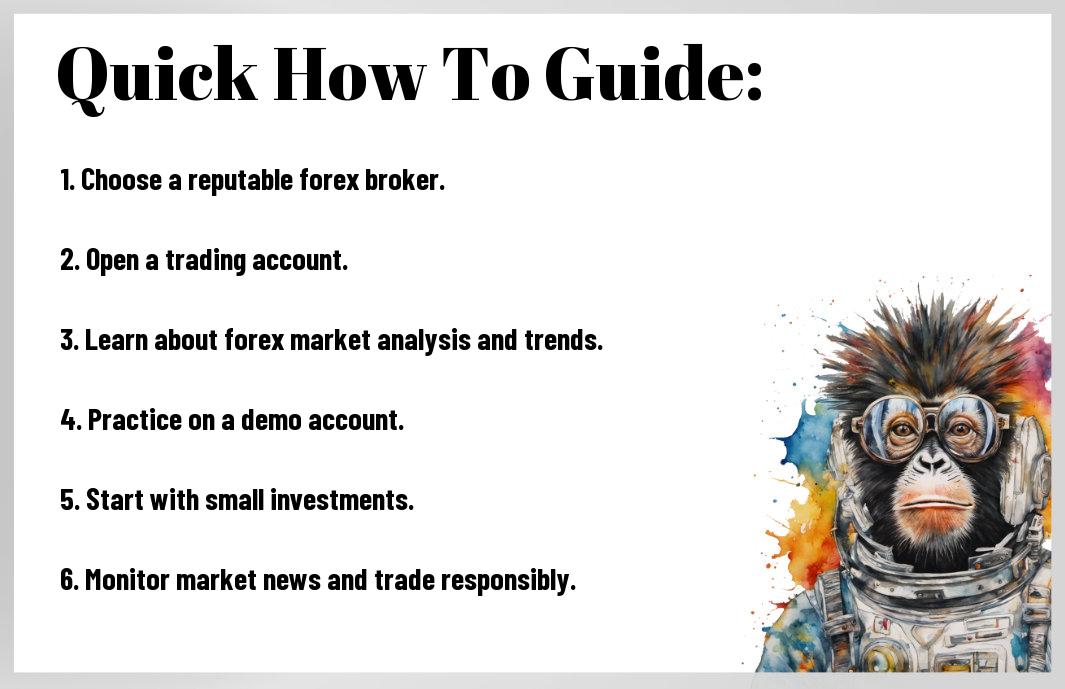

How-To: Getting Started with Forex Trading

Setting Up Your Forex Trading Account

Your first step in entering the world of forex trading is setting up a trading account. Research different brokers to find one that suits your needs. Ensure they are regulated by a reputable financial authority to protect your investment. Once you’ve chosen a broker, complete the necessary registration forms and submit the required documents. With your account set up, you can deposit funds and start trading.

Tips for Selecting a Reputable Forex Broker

Getting started with forex trading means finding a reputable forex broker to facilitate your trades. Look for brokers with a solid reputation, competitive spreads, and a user-friendly trading platform. Check for proper regulation and make sure they offer the currency pairs and trading tools you require. Remember to read reviews and get recommendations from other traders to ensure you choose a reliable broker.

- Research different brokers before making a decision.

- Look for brokers with a solid reputation and proper regulation.

- Consider the range of currency pairs and trading tools offered.

- Get recommendations from other traders before making a final choice.

Even though the forex market offers lucrative opportunities, it is necessary to conduct thorough research and select a trustworthy broker to navigate the complexities of trading. Any dishonest practices or lack of regulation could lead to significant financial losses.

Strategies for Successful Forex Trading

Analyzing Market Factors That Affect Forex

Many factors influence the forex market, and successful traders must be adept at analyzing these variables. Market factors such as economic indicators, political events, and global news can all impact currency prices. To make informed decisions, traders need to stay informed about these factors and understand how they can affect the market in the short and long term. Technical analysis and fundamental analysis are common strategies used to analyze market factors and predict future price movements in the forex market.

- Economic indicators such as GDP growth, inflation rates, and employment data

- The impact of political events and geopolitical tensions on currency values

- Global news events that can cause volatility in the forex market

Assume that a trader who is well-versed in analyzing these factors will have a competitive edge in the forex market.

Developing a Solid Trading Plan

There’s no substitute for a well-developed trading plan when it comes to forex trading. A solid trading plan outlines a trader’s goals, risk tolerance, and investment strategy. It should also include rules for trade entries and exits, as well as guidelines for money management. Developing a solid trading plan helps traders stay disciplined and avoid impulsive decisions that can lead to losses.

Developing a trading plan tailored to your individual trading style and goals is crucial for long-term success in the forex market. Having a structured plan in place can help traders minimize risks and maximize profits.

Risks and Money Management

Understanding and Mitigating Risks

Once again, when trading forex, it’s crucial to understand the risks involved. The forex market is highly volatile, and prices can change rapidly, leading to potential losses. To mitigate these risks, traders should use stop-loss orders, diversify their portfolio, and avoid risking more than they can afford to lose.

Tips for Effective Money Management in Forex

Now, effective money management in forex is vital for long-term success. Setting a risk-to-reward ratio, using proper position sizing, and avoiding emotional trading are key strategies. This will help traders protect their capital and maximize profits.

- Set a risk-to-reward ratio

- Use proper position sizing

- Avoid emotional trading

Money management is the cornerstone of successful trading. By implementing these strategies, traders can enhance their chances of success while minimizing potential losses. This is crucial in the highly volatile world of forex trading.

Advanced Forex Trading Techniques

To trade forex successfully, advanced techniques are required. Here are some strategies to consider:

| Using Technical Analysis | Incorporating Fundamental Analysis |

| Utilize charts, patterns, and indicators to predict future price movements. | Consider economic indicators, geopolitical events, and market sentiment to make trading decisions. |

Using Technical Analysis to Trade Forex

Techniques: Technical analysis involves studying historical price data to forecast future price movements. Traders use various tools like moving averages, RSI, MACD, and Fibonacci retracements to identify trends and entry/exit points. By understanding chart patterns and indicators, traders can make informed decisions and manage risk effectively.

Incorporating Fundamental Analysis in Your Strategy

Incorporating: Fundamental analysis is crucial for long-term success in forex trading. By analyzing economic data, central bank policies, and global events, traders can gauge the intrinsic value of a currency. With a solid understanding of fundamental factors, traders can make more informed decisions and anticipate market movements. However, it’s necessary to combine both technical and fundamental analysis to have a comprehensive trading strategy.

Maintaining Discipline and Mindfulness

The Psychology of Forex Trading

On the psychological front, it is crucial for forex traders to manage their emotions effectively. The fluctuations in the market can evoke feelings of fear, greed, and excitement, leading to impulsive trading decisions. It is imperative to remain composed and rational, sticking to your trading plan even during volatile times. Implement risk management strategies to prevent emotional trading and maintain a disciplined approach.

Practicing Responsible Trading Habits

Even the most experienced traders can fall into the trap of overtrading or taking excessive risks. It is imperative to cultivate responsible trading habits by setting clear goals, establishing stop-loss orders, and adhering to predetermined risk-reward ratios. Practice good money management techniques, such as only risking a small portion of your capital on each trade and avoiding the temptation to chase losses. Consistency in following these habits will lead to long-term success in forex trading.

Understanding the importance of maintaining discipline and mindfulness in forex trading cannot be overstated. Impulsive decisions can lead to significant financial losses, while a disciplined approach can help traders weather market storms and capitalize on profitable opportunities. By staying focused on your trading plan, managing emotions effectively, and practicing responsible habits, you can enhance your chances of success in the competitive forex market.

Growth and Continuous Learning

Importance of Continuing Education in Forex

Unlike other professions, the foreign exchange market is constantly evolving, making it crucial for traders to prioritize continuous learning and growth. Staying updated with new strategies, market trends, and technologies can significantly impact your trading success. If you want to stay ahead in the competitive world of forex trading, committing to ongoing education is non-negotiable.

Resources for Improving Your Forex Trading Skills

Continuous improvement is key in mastering the art of forex trading. There are various resources available to help you enhance your skills and stay informed about the ever-changing market conditions. Online courses, webinars, trading forums, and mentorship programs can provide you with valuable insights and guidance to take your trading to the next level.

For instance, following reputable trading blogs and websites, reading books authored by successful traders, and attending workshops and seminars are all effective ways to expand your knowledge and improve your trading abilities. Note, the more you invest in learning and growing as a trader, the greater your chances of achieving long-term success in the forex market.

Conclusion

Now that you have learned the basics of how to trade forex, you are equipped to start your journey in the financial markets. Remember to always conduct thorough research, develop a solid trading plan, and manage your risks effectively. Stay disciplined, keep emotions in check, and continuously learn from your experiences to improve your trading skills. With dedication and perseverance, you can navigate the forex market successfully and potentially achieve your financial goals.

FAQ

Q: What is forex trading?

A: Forex trading, also known as foreign exchange trading, involves the buying and selling of currency pairs on the foreign exchange market. Traders aim to profit from fluctuations in exchange rates between different currencies.

Q: How can I start trading forex?

A: To start trading forex, you need to open a trading account with a reputable forex broker, deposit funds into your account, choose a currency pair to trade, analyze the market, and enter and monitor your trades. It is important to have a solid understanding of fundamental and technical analysis to make informed trading decisions.

Q: What are some key factors to consider when trading forex?

A: When trading forex, it is crucial to consider factors such as economic indicators, geopolitical events, central bank announcements, and market sentiment. Risk management is also important to protect your capital, including setting stop-loss orders and not risking more than you can afford to lose on a single trade.