The foreign exchange market, better known as Forex, is a vast and dynamic arena where currencies are traded. For those looking to enter the world of financial trading, Forex offers unique opportunities for profit, but it also comes with its fair share of risks. It’s crucial to understand that while profit potential is high, equally high are the possibilities for losses. With the right knowledge, strategy, and discipline, individuals can indeed find success in Forex trading and potentially achieve profitable returns. However, it’s vital to undertake thorough research, proper risk management, and ongoing education to navigate this complex and volatile market effectively.

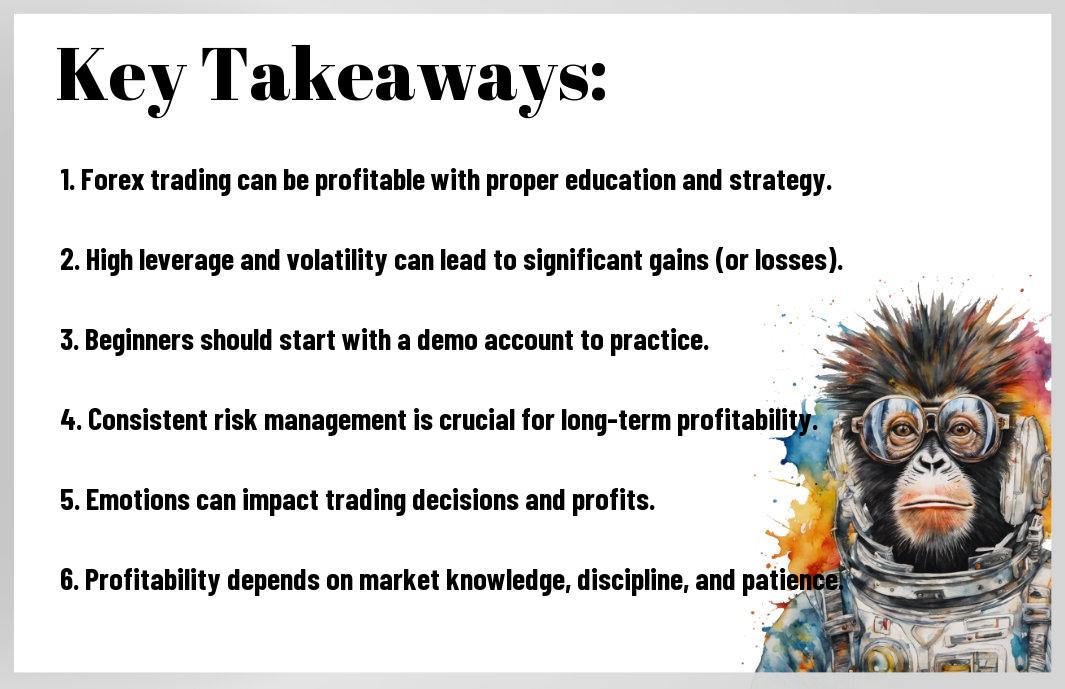

Key Takeaways:

- Forex trading can be profitable: With proper understanding, skills, and a disciplined approach, forex trading has the potential to be profitable.

- Risks are high: Forex trading involves significant risks due to market volatility, leverage, and other factors. It is crucial to manage risks effectively to protect your investment.

- Education and practice are crucial: To increase your chances of profitability in forex trading, it is crucial to educate yourself about the market, develop a trading strategy, and practice it with a demo account before risking real capital.

Understanding the Forex Market

You, as an aspiring forex trader, must first understand the dynamics of the forex market before submerging into the world of trading. This vast decentralized market operates 24 hours a day, five days a week, with trillions of dollars being traded daily. Understanding how the forex market works is crucial for your success in trading.

Key Forex Trading Concepts

On your journey to becoming a successful forex trader, it is crucial to grasp key concepts such as leverage, margin, pips, and lots. These fundamental concepts form the foundation of forex trading and can significantly impact your trading decisions and overall profitability.

Factors Influencing Forex Market Dynamics

Market volatility in the forex market is influenced by various factors including economic indicators, geopolitical events, central bank policies, and market sentiment. Understanding how these factors interact and impact currency prices is crucial for making informed trading decisions. After all, staying informed and adaptable to these changing dynamics is key to success in forex trading.

- Economic indicators such as GDP, employment data, and inflation rates can significantly affect currency values.

- Geopolitical events like elections, wars, and trade agreements can create market volatility.

- Central bank policies on interest rates and monetary policy play a crucial role in currency valuation.

- Market sentiment can shift rapidly based on news, market trends, and global events, impacting currency prices.

A deep understanding of how these factors influence the forex market dynamics can help you anticipate and capitalize on market movements. Keep in mind, staying informed and adaptable is crucial in the ever-changing world of forex trading.

Strategies for Profitable Forex Trading

All Is Forex Trading Really Profitable? Facts and Myths

Fundamental Analysis in Forex

The fundamental analysis in Forex involves studying the economic indicators of different countries to make informed trading decisions. Traders analyze factors such as interest rates, employment data, GDP growth, and geopolitical events to predict the future movements of currency pairs. By understanding the underlying economic factors driving price movements, traders can make more accurate predictions and increase their chances of profitable trades.

Technical Analysis and Chart Patterns

One of the most popular strategies for profitable Forex trading is technical analysis and chart patterns. Traders use historical price data, indicators, and chart patterns to identify trends and patterns in the market. By studying price movements and identifying key levels of support and resistance, traders can make informed decisions about when to enter or exit a trade. This strategy helps traders to capitalize on market trends and maximize profits.

This strategy is powerful because it allows traders to spot opportunities based on historical price movements and patterns. By using technical analysis and chart patterns, traders can develop a systematic approach to trading that helps them make more informed decisions and minimize risks. However, it is important to note that while technical analysis can be a valuable tool, it is not foolproof and requires constant monitoring and adjustment to be successful.

Risks and Management in Forex Trading

Common Risks in Forex Markets

Risks in forex trading include market risk, where the value of currencies fluctuates, as well as leverage risk that amplifies both profits and losses. Liquidity risk could lead to difficulties in buying or selling currencies, while political and economic events can have a direct impact on currency values.

Risk Management Techniques

Forex traders employ various risk management techniques to protect their investments. Setting stop-loss orders helps limit potential losses by automatically closing a trade at a predetermined price level. Diversification involves trading multiple currency pairs to spread risk. Additionally, traders can use risk-to-reward ratios to determine if a potential trade is worth the risk.

Techniques such as proper risk assessment, money management, and utilizing risk management tools can help traders navigate the volatile forex market more effectively. By implementing these techniques, traders can mitigate potential losses and increase their chances of long-term profitability.

Realistic Expectations and Profitability

Setting Achievable Goals in Forex Trading

Many traders enter the forex market with high hopes of making huge profits quickly. However, it is important to set achievable goals in forex trading to prevent disappointment. To succeed in the forex market, traders should focus on consistent growth and risk management rather than aiming for overnight success. Setting achievable goals involves realistic expectations of profits, losses, and the time needed to achieve them.

Measuring Success Beyond Profits

To measure success beyond profits in forex trading, traders should consider various factors besides their financial gains. One crucial aspect is the improvement in trading skills and knowledge over time. Emotional control and discipline are also key measures of success as they can significantly impact a trader’s performance in the long run. By focusing on these areas, traders can gauge their progress accurately and make necessary adjustments to achieve sustainable profitability in the forex market.

Goals should be set based on a trader’s risk tolerance, financial goals, and time commitment to forex trading. It is crucial to have a clear plan in place and stick to it to avoid impulsive decisions that can lead to significant losses. By setting realistic goals, measuring success beyond profits, and focusing on continuous improvement, traders can enhance their chances of profitability in the forex market.

Summing up

Now, after analyzing the ins and outs of forex trading and the factors that influence profitability, it is clear that forex trading can be profitable for those who are well-informed, disciplined, and dedicated. While there are risks involved, with the right knowledge, strategy, and risk management, it is possible to make significant profits in the forex market. It is important to remember that success in forex trading requires time, effort, and continuous learning to stay ahead of the game and maximize profits.

FAQ

Q: Is forex trading profitable?

A: Yes, forex trading can be profitable if done right. It is a high-risk, high-reward market where traders can make significant profits by buying and selling currency pairs. However, it requires knowledge, experience, and a well-thought-out trading strategy to be consistently profitable.

Q: What factors influence the profitability of forex trading?

A: Several factors can impact the profitability of forex trading, including market conditions, economic indicators, geopolitical events, and trader psychology. Being aware of these factors and how they interact with each other is necessary for making informed trading decisions and maximizing profitability.

Q: How can I improve my chances of success in forex trading?

A: To increase your chances of success in forex trading, you should educate yourself about the market, develop a trading plan, use risk management techniques, and stay disciplined. Continuous learning, practicing with a demo account, and seeking guidance from experienced traders can also help improve your skills and profitability in forex trading.